One of the other ways to use Highnote that extremely benefits all is a listed property link tour. You can share additional photos, floorplan, zoning and bylaws of the city, potentials, highlights, 3D virtual matter port, your own video walkthrough and marketing material in addition to all other features about that specific property all in one link.

Free Lender Presentation Template

Take advantage of the free lender presentation template powered by Highnote. It’s as simple as it gets – just duplicate your favorite lender presentation template, customize it, add your information, and you’re good to go!

15 assets below

Meet the Agent

This section of the free lender presentation template introduces the dedicated agent who will guide clients through the lending process. It offers a brief background on the agent's experience, expertise, and how they can assist in finding the perfect loan. The aim is to build trust and rapport with potential clients by showcasing the agent's qualifications and dedication to client satisfaction.

Open Highnote Template

About the Company

This part of the lender presentation template provides an overview of the lending company, including its mission, history, and core values. It highlights the company's track record of success, customer satisfaction, and its role in the community. This section is designed to assure clients of the company's stability, reliability, and dedication to ethical lending practices, reinforcing why they are a trusted choice in the mortgage industry.

Open Highnote Template

Services Offered

Here, clients are introduced to the comprehensive range of mortgage services provided by the company. From first-time homebuyer loans to refinancing options, this section outlines each service's features and benefits. It is meant to inform clients of their options and how the company can cater to diverse needs, whether they're buying a new home, refinancing, or seeking specialized loan products.

Open Highnote Template

Finding The Right Loan for You

This segment is tailored to help clients understand how the company assists in matching them with the ideal loan based on their financial situation and goals. It covers the process of assessing clients' needs, the criteria used to find the best loan options, and how personalized advice is provided to make informed decisions. The focus is on customization and support, ensuring clients feel guided every step of the way.

Open Highnote Template

The Path to Your First Home

Aimed specifically at first-time homebuyers, this section outlines the steps involved in purchasing a first home, from pre-approval to closing. It demystifies the home buying process, offering tips, timelines, and what to expect. This educational approach aims to empower new buyers with knowledge, making the journey to homeownership less daunting and more accessible.

Open Highnote Template

Buying A New House

This part of the presentation is designed for those looking to purchase a new home, whether upgrading or buying an additional property. It covers the key considerations when buying a new house, the advantages of new construction, and how the company can facilitate the financing process. Clients are encouraged to explore their options and understand the benefits of new homeownership with the company's assistance.

Open Highnote Template

Refinance

In this section, clients learn about the refinancing options available to them, including the potential benefits such as lower interest rates, reduced monthly payments, or changing the loan term. It explains the refinancing process, eligibility criteria, and how refinancing can align with clients' financial strategies. The goal is to provide clarity on refinancing and how it can be a tool for financial improvement.

Open Highnote Template

Our Loan Process at The Company

This segment takes clients through the company's step-by-step loan process, from application to approval and closing. It emphasizes transparency, efficiency, and support throughout each phase, providing a clear roadmap of what clients can expect. This detailed breakdown is intended to reassure clients of a smooth, understandable, and hassle-free experience.

Open Highnote Template

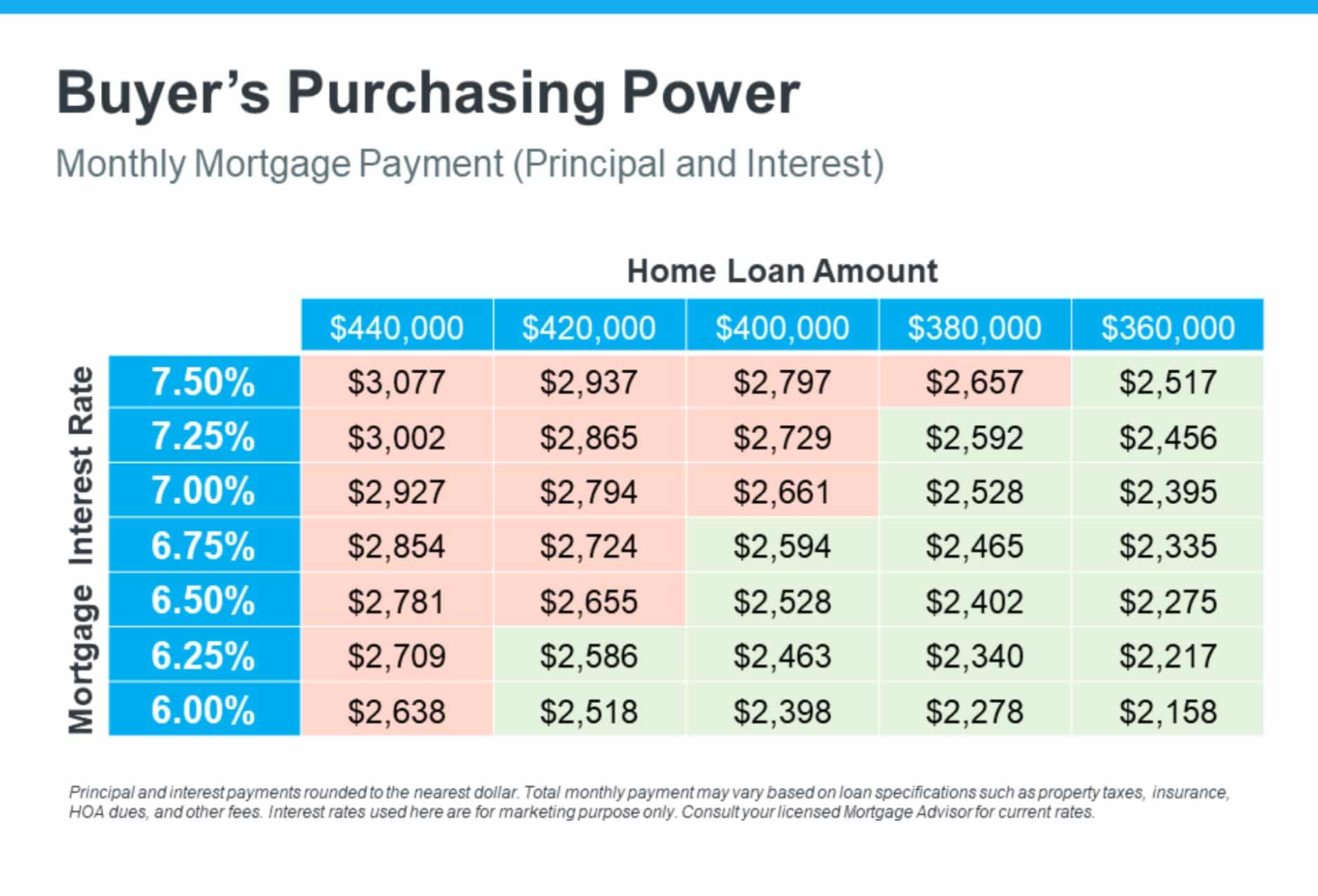

Buying Power

Here, clients are educated on the concept of buying power and how it is determined by factors such as income, debt, credit score, and interest rates. This section aims to help clients assess their own buying power and how it affects their home purchasing options. It’s a crucial piece for setting realistic expectations and planning financially for a future purchase.

Open Highnote Template

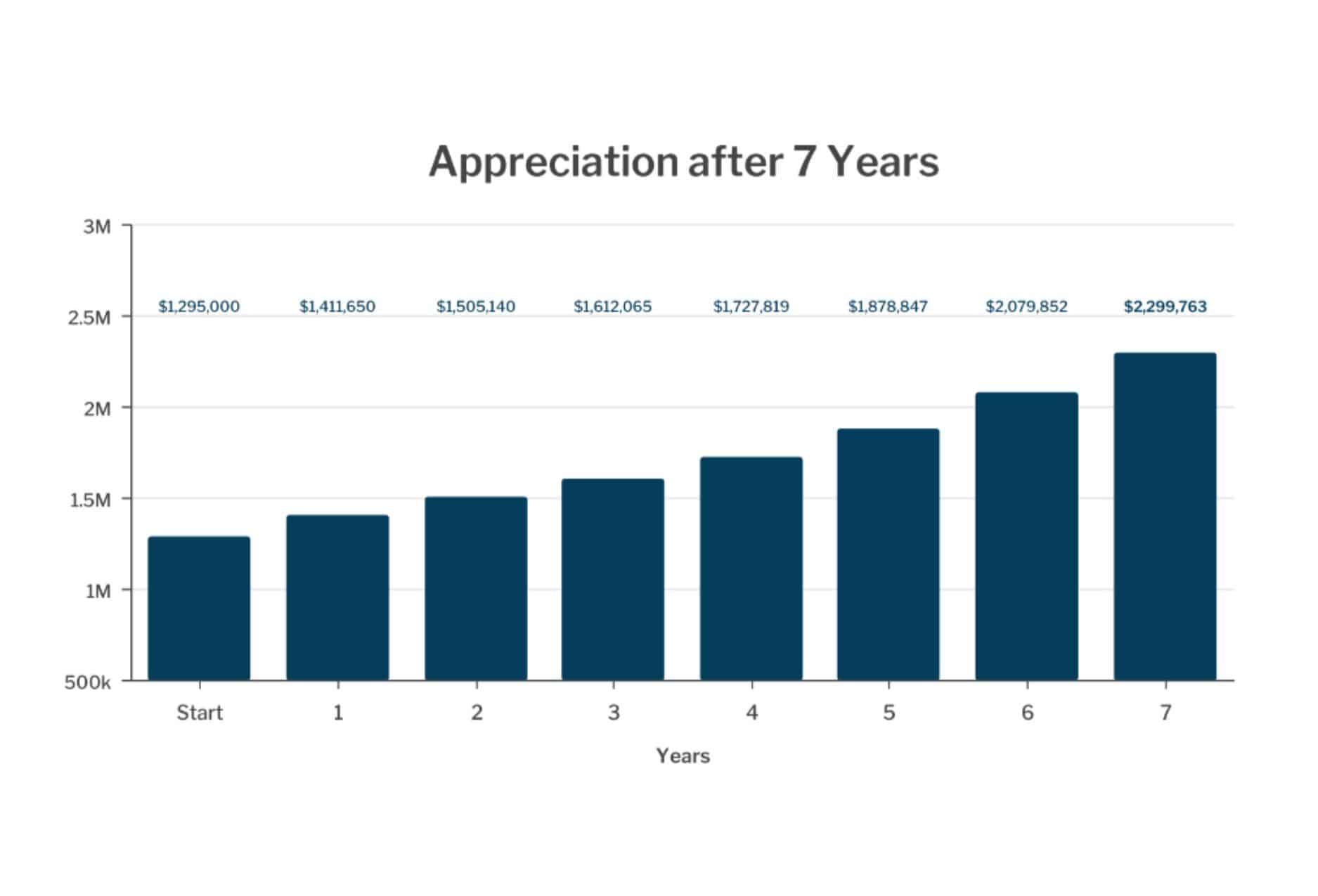

Appreciation

This part of the presentation focuses on the financial benefits of homeownership, specifically property appreciation over time. Using graphs, it illustrates potential appreciation after several years, cumulative appreciation considering closing costs, and the return on investment percentage based on a down payment. This data-driven approach aims to highlight the long-term value and investment potential of buying a home.

Open Highnote Template

Mortgage Recurring vs. Non-Recurring Costs

This section of the lender presentation template breaks down the costs associated with obtaining a mortgage, distinguishing between recurring costs (like property taxes and insurance) and non-recurring closing costs (such as fees and one-time payments). It’s designed to educate clients on the financial commitments of a mortgage, helping them budget and prepare for both the upfront and ongoing costs of homeownership.

Open Highnote Template

Common Life Events That Can Keep Your Loan From Closing on Time

This segment addresses potential hurdles in the loan closing process, such as changes in employment, credit score fluctuations, or significant purchases. By identifying common issues, the company aims to guide clients on how to avoid these pitfalls, ensuring a timely and smooth closing.

Open Highnote Template

Buy or Rent: Which One Should You Choose?

This part offers a comparative analysis of buying vs. renting, considering financial, lifestyle, and long-term implications. It aims to provide clients with a balanced perspective, helping them make an informed decision based on their personal circumstances and financial goals.

Open Highnote Template

Client Testimonials

Featuring real-life stories and feedback from satisfied clients, this section is designed to build confidence in the company's services through social proof. Testimonials highlight the positive experiences of past clients, showcasing the company's expertise, customer service, and successful outcomes.

Open Highnote Template

Let’s Get Started

The closing section of the presentation is a call to action, encouraging clients to take the next step in their home financing journey with the company. It provides information on how to get in touch, what information to prepare, and reassures clients of the company's commitment to guiding them through the process. This final note is meant to motivate and invite clients to embark on their path to homeownership with the company's support.

Open Highnote Template

I look forward to having a more in-depth conversation with you soon.

- by Leandro Grant

- November 7, 2023

Sections Include:

Testimonials

Axel Ziba

Broker, Partner, Team Manager

I recently sent a Highnote that includes a video of a penthouse I have listed in downtown Columbus. A number of people watched it multiple times. Thank you for creating this system. It has been extremely beneficial!

Kelly Cantwell

Real Estate Agent

Highnote is a game changer. It provides an easy to use platform to create a unique, appealing and professional presentation for all of our luxury listings. We can also track our open rate and see who is viewing the presentation. We love the platform.

Nancy Braun

Owner, Broker, Manager

Benefits of Using Lender Presentation Template

Today, we unravel the secret weapon that successful financial professionals rely on: Highnote’s Lender Presentation Templates. These templates aren’t just tools; they are your gateway to impactful financial presentations that elevate your business. Crafting a compelling lender presentation is the key to persuading home buyers and showcasing expertise.

Crafting a Powerful Narrative

When it comes to mortgage advising, storytelling can be a powerful tool. Highnote’s Lender Presentation Templates are designed to help you weave a compelling narrative that captivates your audience. You can leverage these lender presentation templates to showcase your expertise, and build trust and connection with potential clients. The templates guide users in structuring their presentations in a way that engages and informs, ensuring that every client understands the value you bring to the table.

Tailored for Mortgage Advisors

Not all presentations are created equal, and that’s especially true in the mortgage industry. Highnote understands the unique needs of professionals who require lender presentations that are not just visually appealing but also specifically tailored to the intricacies of mortgage advising. The templates come pre-loaded with sections that cater to the specifics of mortgage advisory, saving time and effort in customization.

Impress with Professionalism

First impressions matter; a professionally crafted lender presentation can set the tone for a successful client-advisor relationship. Highnote’s lender presentation templates are designed with a sleek and polished aesthetic, ensuring that your presentations exude professionalism. Whether presenting to first-time homebuyers or seasoned investors, these templates provide a visually stunning backdrop that reflects positively on the advisor and the information being presented.

Time-Efficient Customization

The most successful mortgage professionals need efficiency in their workflow. Highnote’s lender presentation templates streamline the customization process, allowing for quick and easy adaptation to specific clients or scenarios. This time efficiency translates to increased productivity, enabling you to focus more on your clients and less on the intricacies of presentation design.

Tailored Customization

While templates offer structure, they don’t compromise on flexibility. Highly customizable, each presentation can be personalized to align with your brand and the specific needs of your audience. This customization ensures that your proposals are not just templates but strategic documents crafted for success.

Data-Driven Insights

Highnote’s templates allow seamless integration of vital financial data and statistics. Transform your presentations into persuasive documents backed by insightful metrics. Showcase the potential impact of financial strategies with clarity and confidence.

Brand Consistency

Consistency is paramount in lender presentations. Highnote’s templates guarantee that your brand identity remains consistent, reinforcing your image as a trustworthy and results-oriented professional.

Elevate Your Business with Highnote’s Lender Presentation Templates

Highnote’s Lender Presentation Templates aren’t just about aesthetics; they are about empowering professionals to thrive in their presentations. Here’s how they take your financial game to the next level:

Visual Excellence for Impactful Presentations

These templates go beyond standard presentations. They create a visual impact that resonates with home buyers and clients alike. Engaging design elements and organized structures enhance the overall presentation, making your lender presentations stand out.

Effortless Customization for Maximum Impact

Highnote’s user-friendly interface ensures that customization is a breeze. Tailor each presentation with ease to suit the unique requirements of your audience, adding a personal touch that demonstrates your commitment to their homebuying journey.

Tracking Integration for Informed Strategies

Highnote’s templates aren’t static but dynamic tools equipped with tracking capabilities. Understand how home buyers engage with your presentations, gain insights into their preferences, and use this data to refine your strategies for better results.

Seamless Delivery for Client Convenience

Beyond creation, Highnote simplifies the sharing process. Generate shareable links to your presentations and effortlessly send them to homebuyers via email or other communication channels. Accessibility on various devices ensures a seamless experience for your clients.

FAQ About Lender Presentation Template

How much does Highnote cost?

Highnote offers monthly and annual billing to accommodate varying needs. The exact cost depends on your chosen billing cycle. The annual subscription costs $29 per month, while the monthly subscription costs $35.