Few things are certain in life, but here’s one thing we know for sure: the real estate market is insane right now. That pretty much goes for everywhere in the country, from rural Georgia to downtown Seattle. But what happens when you throw in some sunny weather and beautiful beaches?

Jeff Lichtenstein of Echo Fine Properties in Palm Beach County, Florida, sat down to tell us how the market is doing there, and how buyers can sweeten the deal when they find themselves in a high offer.

Hi, Jeff! Thanks for calling in from beautiful Florida. Can you tell me a little bit about yourself and how you got into real estate?

Sure. I’ve been in real estate for about 20 years. Before that, I was in the home furnishing fabric industry for about a decade. I primarily did sales, I was on the road doing territory sales/territory sales management for 30 to 35 weeks per year. Once I started being a real estate agent, I was carrying anywhere from 20 to 60 pieces of inventory a year. I did that for a good decade, and then I started to build a large team that morphed into a brokerage over time. And now the brokerage is a couple years old, and we’re at about 67 people right now.

Does your brokerage specialize in a certain type of property?

We do a little bit of everything, our range is from about $300,000 to over $10 million. We really run the gamut. We’re mostly in the northern Palm Beaches, but we’re expanding in some other areas as well.

The market is so crazy right now, no matter where you turn. What’s it like there? Are buyers even more competitive when it comes to living near the beach?

I would say competition in our area is probably the among the strongest in the United States, for a multitude of reasons. There’s more movement to our area, largely due to our lack of income tax. Our weather is phenomenal all year round. With the pandemic, people have wanted more space. Twenty years ago when I came here, I was more of a pioneer. The population of Jupiter was 30,000 and I think we’re at 65,000 today. So the infrastructure of people down here has changed. People on the East Coast or in the Midwest often have a friend or relative living here, they know about it. And that wasn’t always the case before.

There also wasn’t as much culture here going back 20 or 30 years ago. Today, there is. We have three major airports to choose from here. Our area is below the freezing line, and by the ocean and the Intracoastal Waterway.

Over the last 20 years, our area has become built out. We are out of land at this point. The building that’s taking place here is west of us and then going north for 20-30 minutes. So we’re running into a situation where the inland property has become like waterfront property; it’s become much more rare and hard to find.

We’ve seen anywhere from 30-50% appreciation in the single-family home market, and bidding wars. We worked with a buyer the other day who bid on a house that was listed at $5.3 million, and we won the bid at $6.1 million. A property that last year would have been listed at $599,000 we would now list at $799,000. And it gets seven cash offers between 8am and 11am, with an escalation clause that brings it to $820,000. That’s commonplace now.

We’re running near a zero inventory situation. For example, in a development like PGA National which has 5,000 homes, we should be seeing around 100 homes on the market. We’re only seeing about 19. In the development I live in, there are 600 homes. I think there are only two or three on the market. A few weeks ago, there weren’t any.

Do you foresee the inventory situation getting better soon?

There are some pent-up sellers out there. For instance, I got a call the other day about somebody moving to more of a retirement/assisted living facility. They were older, their wife had passed away 1.5 years ago. I think that call to me to list his house would have usually happened nine months ago, but because of the pandemic he didn’t want to have his house on the market. So if you take the 50+ crowd, those people have held off moving because of COVID-19. So I think there is pent-up demand – more than a year’s worth of pent-up demand. For instance, now that man who called me feels comfortable moving to an assisted living community; he’s been vaccinated and he feels safer.

And then there’s the foreclosure market which has been held off for a year, although values have gone up. So there are a lot of interesting things at play. But you know, we also just don’t have the supply in the US. I was reading a Wall Street Journal article recently which said that we’re 3.8 million homes short due to a lack of building over time. So some of it’s really hard to tell, how this will all end up.

When it comes to bidding on a house, most people assume the highest offer always wins – but you say that’s not the case, right?

We did a training session for our agents and I wrote down 19 things you can do to sweeten the deal. The first thing is to train your buyer. You need to spend a good 30 minutes or an hour on a Zoom call or in person, getting them to understand the market. Because if they’re not prepared, they’re going to burn their hand on the stove once or twice or three times, and they’re probably going to fire you because they blame you. So training the client is important because there’s absorption of different philosophies. So if you can show – and HighNote is a really good tool for this – what an escalation clause is and what it looks like and why you use it, they may not totally get it but at least they’ve already heard of it.

The agent has to take control of the situation like a tour guide would in another country. You can’t just let your buyer dictate every word. You have to have a plan, a schedule.

The next thing is individual strategies. One of them is that buyers and sellers always want to get a good deal. A buyer might say “there’s something on the inspection report. It’s not fair that I should have to pay for that repair.” Right now you have to understand that the sellers hold all the cards. You’re going to be in a bidding war. So the mindset of the “good deal” is winning the deal and acting accordingly.

Speed is a major factor. When you write an offer, you just have to write it. Our contracts are “as is,” meaning the buyer has a free option to cancel. You could write 100 contracts tomorrow and cancel them all using that particular clause. So you can’t sleep on it overnight and think about whether you want to buy it. Write the contract, cancel it afterwards.

Include short periods of acceptance. If you see a house at 10am, write up the offer and give them until 5pm to respond. You can’t give them two days to write a response because you’ll just be inviting the competition. Try to get the earliest appointment possible to view a home, because the competition is just around the corner.

We’re using the escalation clause a lot, that’s like a price match guarantee. So let’s say your buyer makes an offer for $811,000 but they’re willing to go up to $820,000. You can write it in the contract that if someone matches the buyer’s offer in 24 hours, your buyer will match it and go up by $1,000.

You can also build escalation dates or de-escalation dates. So if the seller wants to bump the closing out two months, you can do that.

Big deposits. In the past,10% was always a good deposit. But now I’m seeing 25%. I saw one, with a $600,000 house, where they put the whole thing down.

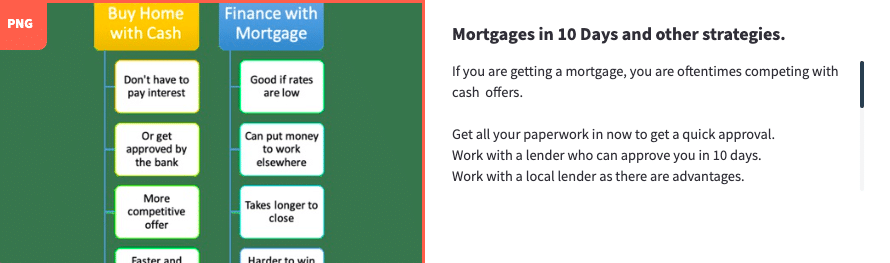

People who are getting mortgages are competing against cash buyers across the board. So a buyer should try to go with a smaller, local bank because they can usually close quicker than a big national bank. Some people are waiving the mortgage contingency, but this is dangerous. If your buyer does that, then they have to be able to close with cash.

I hear you’re also a fan of HighNote. How exactly do you use it?

I use it for everything! On a listing presentation, I used to have links that said “go here,” or “go to this link,” or “look at that.” It was dry and boring. And the consumer today, you know, we’re all on our smartphones and we’re inundated with so much messaging from Facebook, etc., throughout the day. So we have to keep people’s attention. And I think HighNote accomplishes that, because whether you’re putting in a .pdf or a picture, or even a Word document, it’s there. It’s big. It’s like a billboard, and we know billboard ads are very effective.

Every time we go on a listing appointment, we send a HighNote with all the links before we go – like videos on each agent, what we do, our bios, and our real estate agent listing presentation to impress clients. So they get to know our agents on a human level and all the different things that we do in each category. You know, what our brochures look like, what videos look like, what to expect from us, letters of recommendation. So they walk in and they already know who we are beforehand, and they understand our concept.

We have a Home ECHOnomics guarantee – 57 things that we do in writing for each seller so they know exactly what they’re getting from us. So we’re putting that in our HighNotes too.

Right now I’m also doing a bespoke, customized “How to React in an Extreme Seller’s Market So That You Win the Deal” HighNote. And that’s a better presentation of the content; I can communicate better with HighNote than if I just write and send a generic email without the pretty pictures. I think people absorb the information faster this way, by seeing the photos and the writing that’s next to it.

We also use it for onboarding, it’s really helping us go through different things that we’re training on.

I even have some agents who use it for scheduling with their own clients. It lets them know what properties they’re going to see that day, and includes information about the areas, a map of the areas. They send links to the developments and the homes they’ll be viewing.

There’s probably 15 different purposes we’re using HighNote for!

Are you using the analytics feature to see what people are clicking on?

Yeah, it’s great. I know if they’ve opened it up. If they’re looking at it for a long time I know I have an interested party. Or if they haven’t opened it, then in some cases I’ll call and say “Hey, did you see what I sent over?” So I love that feature.

It’s been so wonderful hearing about your brokerage. How’s this year shaping up for you so far?

We have had tremendous growth, we’ll have done as much business by May of this year as the whole of last year – and last year we still saw 50% growth!

Wow! Can you share some of the things that have made your brokerage so successful?

We’re kind of a unique brokerage in that we pay for all the marketing costs internally for the agent, so the agent can do what they do best – which is network and sell. If they’re not doing all the other things and they don’t have to worry about spending money on something, then they excel. That also gives us a little bit more control, we can make sure things don’t go off brand.

Are you using the analytics feature to see what people are clicking on?

Yeah, it’s great. I know if they’ve opened it up. If they’re looking at it for a long time I know I have an interested party. Or if they haven’t opened it, then in some cases I’ll call and say “Hey, did you see what I sent over?” So I love that feature.

It’s been so wonderful hearing about your brokerage. How’s this year shaping up for you so far?

We have had tremendous growth, we’ll have done as much business by May of this year as the whole of last year – and last year we still saw 50% growth!

Wow! Can you share some of the things that have made your brokerage so successful?

We’re kind of a unique brokerage in that we pay for all the marketing costs internally for the agent, so the agent can do what they do best – which is network and sell. If they’re not doing all the other things and they don’t have to worry about spending money on something, then they excel. That also gives us a little bit more control, we can make sure things don’t go off brand.